3 White Soldiers Pattern

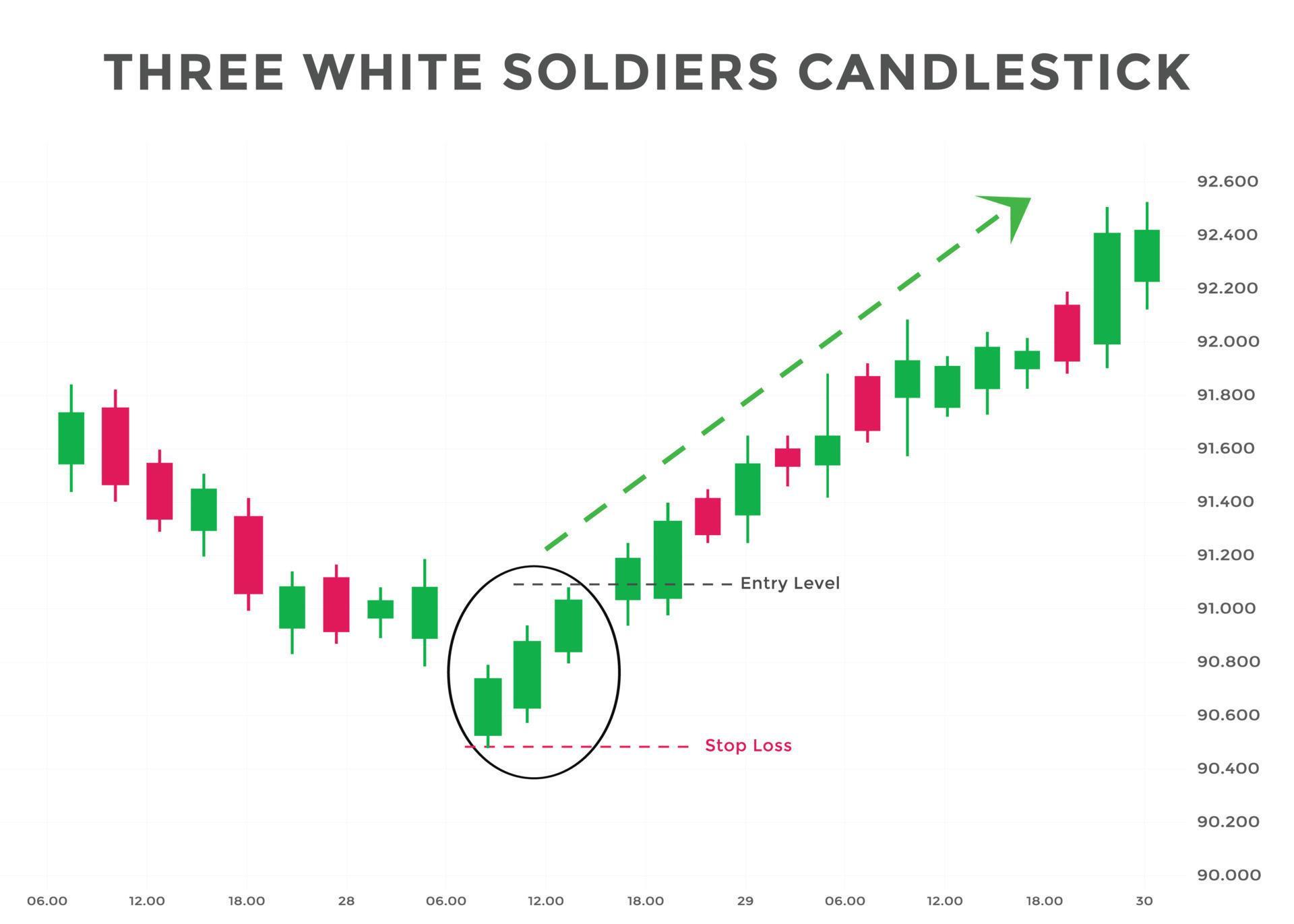

3 White Soldiers Pattern - Web the three white soldiers pattern is a reversal pattern that predicts a change in the direction of a trend. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. Web the three white soldiers pattern explained. Web three white soldiers is a bullish reversal pattern commonly observed in candlestick charting. This pattern, often regarded as a bullish signal, can provide valuable insights. Web three white soldiers candlestick is a multiple candlestick pattern used to analyse charts of stocks, currencies, commodities, etc. Each candle's open price is within the previous candle's body; The bullish three white soldiers is a candlestick pattern signaling a bullish reversal at the end of a downtrend. It consists of three consecutive tall bullish candles, all closing in the upper quarter of their range. Also known as the three advancing white soldiers, this candlestick pattern is used for predicting reversal from a downtrend to an uptrend. The pattern occurs at the bottom of a downtrend as the price hits a strong support level and bearish momentum wanes. Considered a reliable indication that a trend reversal will happen, traders use this pattern to find a potential entry in the market. The name does help you remember this. Web the three white soldiers pattern explained. Web today, let’s dive into a powerful candlestick pattern: Web the three white soldiers pattern had several names historically. Web the three white soldiers pattern is a bullish candlestick formation on a trading chart that occurs at the bottom of a downtrend. Analysts and traders consider the three white soldiers pattern a fairly robust reversal signal. Web three white soldiers is a bullish reversal pattern commonly observed in candlestick charting. Web the three white soldiers pattern is a reversal pattern that predicts a change in the direction of a trend. As the name suggests, the pattern consists of three candles, which are green in colour. The three white soldiers candlestick pattern is recognized if: Moreover, in the right context it can signal a reversal of a trend. This pattern, often regarded as a bullish signal, can provide valuable insights. Web as a triple candlestick pattern, the three white soldiers pattern. Web three white soldiers candlestick is a multiple candlestick pattern used to analyse charts of stocks, currencies, commodities, etc. Web the three white soldiers pattern is a chart pattern seen in technical analysis. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. During. The pattern has three consecutive candles, which will make them less frequent than some other candlestick patterns. Web three white soldiers is a bullish trend reversal candlestick pattern consisting of three candles. Web the three white soldiers pattern explained. The name comes from three white candles, or soldiers, pushing against the downtrend. What that means is it is more likely. Understanding the three white soldiers pattern: This pattern, often regarded as a bullish signal, can provide valuable insights. Web a three white soldiers pattern is a bullish pattern made up of three bullish candlesticks that march their way to victory for the bulls. Also known as the three advancing white soldiers, this candlestick pattern is used for predicting reversal from. Web three white soldiers is a bullish trend reversal candlestick pattern consisting of three candles. Web the three white soldiers pattern explained. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. The three white soldiers pattern is identified by three consecutive bullish candles,. Traders interpret this charting formation as an indicator of a price reversal and the end of the selling pressure. It consists of three consecutive tall bullish candles, all closing in the upper quarter of their range. Web three white soldiers is a bullish trend reversal candlestick pattern consisting of three candles. The bullish three white soldiers is a candlestick pattern. Web the three white soldiers is a reliable bullish reversal pattern in technical analysis, often signaling the end of a downtrend and the start of a new uptrend. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. The three white soldiers pattern is. As the name suggests, the pattern consists of three candles, which are green in colour. Web the three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. The pattern occurs at the bottom of a downtrend as the price hits a strong support level and bearish momentum wanes. Analysts and. Web the three white soldiers candlestick pattern acts as a bullish reversal 82% of the time. Web the three white soldiers is the name of a multiple candlestick formation that technical traders use to analyze charts such as stocks, commodities, currencies, etc. Analysts and traders consider the three white soldiers pattern a fairly robust reversal signal. It unfolds across three. Web the three white soldiers pattern is a reversal pattern that predicts a change in the direction of a trend. It is fairly easy for most traders to spot in real time given the 3 large range successive candles. Considered a reliable indication that a trend reversal will happen, traders use this pattern to find a potential entry in the. During the second world war, some called the pattern the three marching soldiers. Japanese called it the three red soldiers, because what in the western world is referred to as a white candle, they used, in fact, red color. Just 593 out of 3,333 samples showed downward breakouts. Web the three white soldiers pattern is a bullish candlestick formation on a trading chart that occurs at the bottom of a downtrend. The pattern suggests a reversal of a bearish trend. Web the three white soldiers is a bullish candlestick pattern commonly used by stock analysts to predict the reversal of a current downtrend in the market. Web the three white soldiers pattern is a bullish reversal pattern formed by three consecutive candles, which are green (or white) in color. Web as a triple candlestick pattern, the three white soldiers pattern consists of three consecutive bullish candlesticks at the bottom of a downward trend. Read on to learn how it works & if it's reliable for technical analysis. Web three white soldiers is a candlestick chart pattern in the financial markets. Also known as the three advancing white soldiers, this candlestick pattern is used for predicting reversal from a downtrend to an uptrend. Understanding the three white soldiers pattern: Considered a reliable indication that a trend reversal will happen, traders use this pattern to find a potential entry in the market. Web three white soldiers candlestick is a multiple candlestick pattern used to analyse charts of stocks, currencies, commodities, etc. Web three white soldiers is a bullish reversal pattern commonly observed in candlestick charting. Web the three white soldiers is a reliable bullish reversal pattern in technical analysis, often signaling the end of a downtrend and the start of a new uptrend.Three White Soldiers Bullish Candlestick Chart Pattern

Three White Soldiers Reversal Candlestick Pattern

Three White Soldiers Candlestick Pattern in Trading Explained Blog Binomo

three white soldiers pattern candlestick chart pattern. Candlestick

Three White Soldiers Candlestick Pattern Example Bullish Reversal

Three White Soldiers Candlestick Pattern in Trading Explained Blog Binomo

Understanding the Three White Soldiers Pattern Premium Store

3 White Soldiers Chart

Three White Soldiers Candlestick Pattern Forex Trading

What Are Three White Soldiers Candlestick Explained ELM

Here Are The Characteristics Of A.

Web Today, Let’s Dive Into A Powerful Candlestick Pattern:

Moreover, In The Right Context It Can Signal A Reversal Of A Trend.

Each Candle's Open Price Is Within The Previous Candle's Body;

Related Post: